Jobs

Which Jobs Will Be Most Impacted by ChatGPT?

Jobs Most Impacted by ChatGPT and Similar AI Models

On November 30, 2022, OpenAI heralded a new era of artificial intelligence (AI) by introducing ChatGPT to the world.

The AI chatbot stunned users with its human-like and thorough responses. ChatGPT could comprehend and answer a variety of different questions, make suggestions, research and write essays and briefs, and even tell jokes (amongst other tasks).

Many of these skills are used by workers in their jobs across the world, which begs the question: which jobs will be transformed, or even replaced, by generative AI in the coming future?

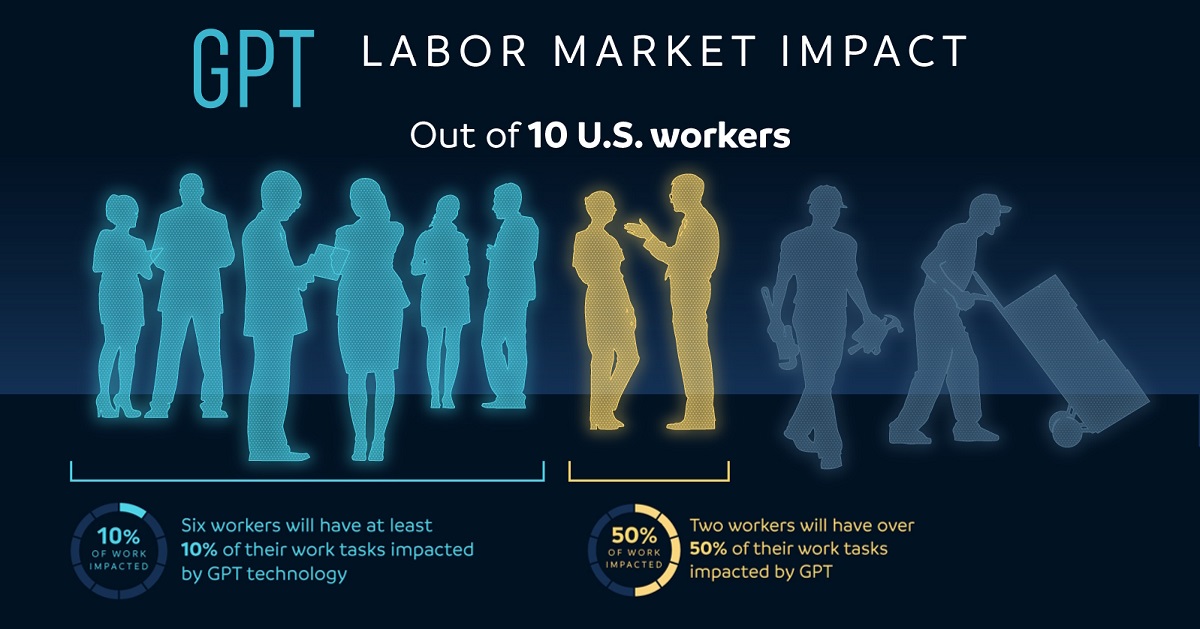

This infographic from Harrison Schell visualizes the March 2023 findings of OpenAI on the potential labor market impact of large language models (LLMs) and various applications of generative AI, including ChatGPT.

Methodology

The OpenAI working paper specifically examined the U.S. industries and jobs most “exposed” to large language models like GPT, which the chatbot ChatGPT operates on.

Key to the paper is the definition of what “exposed” actually means:

“A proxy for potential economic impact without distinguishing between labor-augmenting or labor-displacing effects.” – OpenAI

Thus, the results include both jobs where humans could possibly use AI to optimize their work, along with jobs that could potentially be automated altogether.

OpenAI found that 80% of the American workforce belonged to an occupation where at least 10% of their tasks can be done (or aided) by AI. One-fifth of the workforce belonged to an occupation where 50% of work tasks would be impacted by artificial intelligence.

The Jobs Most and Least at Risk of AI Disruption

Here is a list of jobs highlighted in the paper as likely to see (or already seeing) AI disruption, where AI can reduce the time to do tasks associated with the occupation by at least 50%.

Analysis was provided by a variety of human-made models as well as ChatGPT-4 models, with results from both showing below:

| Jobs | Categorized By | AI Exposure |

|---|---|---|

| Accountants | AI | 100% |

| Admin and legal assistants | AI | 100% |

| Climate change policy analysts | AI | 100% |

| Reporters & journalists | AI | 100% |

| Mathematicians | Human & AI | 100% |

| Tax preparers | Human | 100% |

| Financial analysts | Human | 100% |

| Writers & authors | Human | 100% |

| Web designers | Human | 100% |

| Blockchain engineers | AI | 97.1% |

| Court reporters | AI | 96.4% |

| Proofreaders | AI | 95.5% |

| Correspondence clerks | AI | 95.2% |

| Survey researchers | Human | 84.0% |

| Interpreters/translators | Human | 82.4% |

| PR specialists | Human | 80.6% |

| Animal scientists | Human | 77.8% |

Editor’s note: The paper only highlights some jobs impacted. One AI model found a list of 84 additional jobs that were “fully exposed”, but not all were listed. One human model found 15 additional “fully exposed” jobs that were not listed.

Generally, jobs that require repetitive tasks, some level of data analysis, and routine decision-making were found to face the highest risk of exposure.

Perhaps unsurprisingly, “information processing industries” that involve writing, calculating, and high-level analysis have a higher exposure to LLM-based artificial intelligence. However, science and critical-thinking jobs within those industries negatively correlate with AI exposure.

On the flipside, not every job is likely to be affected. Here’s a list of jobs that are likely least exposed to large language model AI disruption.

| Jobs Least Exposed to AI | |

|---|---|

| Athletes | Short-order cooks |

| Large equipment operators | Barbers/hair stylists |

| Glass installers & repairers | Dredge operators |

| Automotive mechanics | Power-line installers/repairers |

| Masons, carpenters, roofers | Oil field maintenance workers |

| Plumbers, painters, pipefitters | Servers, dishwashers, bartenders |

Naturally, hands-on industries like manufacturing, mining, and agriculture were more protected, but still include information processing roles at risk.

Likewise, the in-person service industry is also expected to see minimal impact from these kinds of AI models. But, patterns are beginning to emerge for job-seekers and industries that may have to contend with artificial intelligence soon.

Artificial Intelligence Impacts on Different Levels of Jobs

OpenAI analyzed correlations between AI exposure in the labor market against a job’s requisite education level, wages, and job-training.

The paper found that jobs with higher wages have a higher exposure to LLM-based AI (though there were numerous low-wage jobs with high exposure as well).

| Job Parameter | AI Exposure Correlation |

|---|---|

| Wages | Direct |

| Education | Direct |

| Training | Inverse |

Professionals with higher education degrees also appeared to be more greatly exposed to AI impact, compared to those without.

However, occupations with a greater level of on-the-job training had the least amount of work tasks exposed, compared to those jobs with little-to-no training.

Will AI’s Impact on the Job Market Be Good or Bad?

The potential impact of ChatGPT and similar AI-driven models on individual job titles depends on several factors, including the nature of the job, the level of automation that is possible, and the exact tasks required.

However, while certain repetitive and predictable tasks can be automated, others that require intangibles like creative input, understanding cultural nuance, reading social cues, or executing good judgement cannot be fully hands-off yet.

And keep in mind that AI exposure isn’t limited to job replacement. Job transformation, with workers utilizing the AI to speed up or improve tasks output, is extremely likely in many of these scenarios. Already, there are employment ads for “AI Whisperers” who can effectively optimize automated responses from generalist AI.

As the AI arms race moves forward at a rapid pace rarely seen before in the history of technology, it likely won’t take long for us to see the full impact of ChatGPT and other LLMs on both jobs and the economy.

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Economy

Visualizing the Link Between Unemployment and Recessions

This infographic examines 50 years of data to highlight a clear visual trend: recessions are preceded by a cyclical low in unemployment.

The Surprising Link Between Unemployment and Recessions

The U.S. labor market is having a strong start to 2023, adding 504,000 nonfarm payrolls in January, and 311,000 in February.

Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%.

A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement:

You don’t have a recession when you have 500,000 jobs and the lowest unemployment rate in more than 50 years

While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession.

This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter).

With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation.

For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022.

The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make.

Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation.

More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession.

According to the Fed’s own report, if you continue raising interest rates as you plan, unemployment will be 4.6% by the end of the year.

– Elizabeth Warren

Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes.

Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.

-

Datastream3 weeks ago

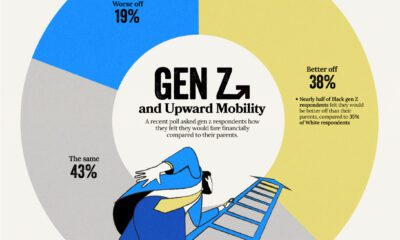

Datastream3 weeks agoHow Gen Z Feels About Its Financial Future

-

AI14 mins ago

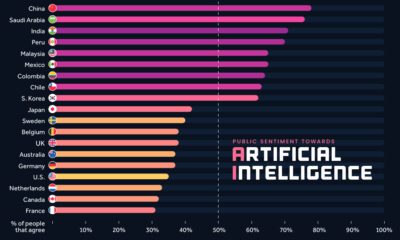

AI14 mins agoVisualizing Global Attitudes Towards AI

-

Politics2 weeks ago

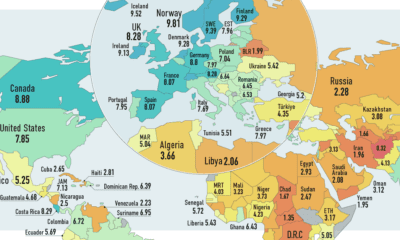

Politics2 weeks agoMapped: The State of Democracy Around the World

-

Technology2 weeks ago

Technology2 weeks agoHow Smart is ChatGPT?

-

Misc2 weeks ago

Misc2 weeks agoVisualizing the Biomass of All the World’s Mammals

-

Misc4 weeks ago

Misc4 weeks agoHave Combustion Vehicle Sales Already Peaked?

-

Personal Finance1 week ago

Personal Finance1 week agoRanked: The Best U.S. States for Retirement

-

Countries4 weeks ago

Countries4 weeks agoVisualizing the World’s Plummeting Fertility Rate