Precious Metals

200 Years of Global Gold Production, by Country

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

Click on the image to view the high-resolution version.

Visualizing Global Gold Production Over 200 Years

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

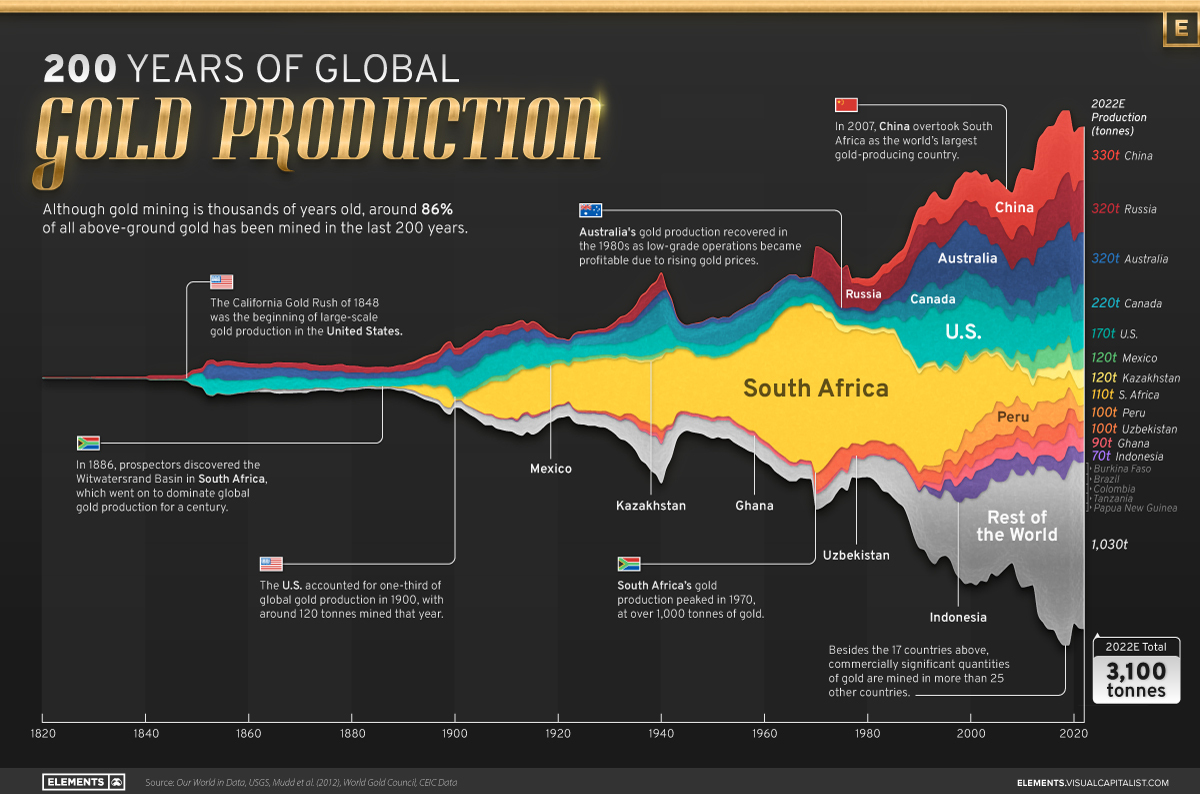

Although the practice of gold mining has been around for thousands of years, it’s estimated that roughly 86% of all above-ground gold was extracted in the last 200 years.

With modern mining techniques making large-scale production possible, global gold production has grown exponentially since the 1800s.

The above infographic uses data from Our World in Data to visualize global gold production by country from 1820 to 2022, showing how gold mining has evolved to become increasingly global over time.

A Brief History of Gold Mining

The best-known gold rush in modern history occurred in California in 1848, when James Marshall discovered gold in the Sacramento Valley. As word spread, thousands of migrants flocked to California in search of gold, and by 1855, miners had extracted around $2 billion worth of gold.

The United States, Australia, and Russia were (interchangeably) the three largest gold producers until the 1890s. Then, South Africa took the helm thanks to the massive discovery in the Witwatersrand Basin, now regarded today as one of the world’s greatest ever goldfields.

South Africa’s annual gold production peaked in 1970 at 1,002 tonnes—by far the largest amount of gold produced by any country in a year.

With the price of gold rising since the 1980s, global gold production has become increasingly widespread. By 2007, China was the world’s largest gold-producing nation, and today a significant quantity of gold is being mined in over 40 countries.

The Top Gold-Producing Countries in 2022

Around 31% of the world’s gold production in 2022 came from three countries—China, Russia, and Australia, with each producing over 300 tonnes of the precious metal.

| Rank | Country | 2022E Gold Production, tonnes | % of Total |

|---|---|---|---|

| #1 | 🇨🇳 China | 330 | 11% |

| #2 | 🇷🇺 Russia | 320 | 10% |

| #3 | 🇦🇺 Australia | 320 | 10% |

| #4 | 🇨🇦 Canada | 220 | 7% |

| #5 | 🇺🇸 United States | 170 | 5% |

| #6 | 🇲🇽 Mexico | 120 | 4% |

| #7 | 🇰🇿 Kazakhstan | 120 | 4% |

| #8 | 🇿🇦 South Africa | 110 | 4% |

| #9 | 🇵🇪 Peru | 100 | 3% |

| #10 | 🇺🇿 Uzbekistan | 100 | 3% |

| #11 | 🇬🇭 Ghana | 90 | 3% |

| #12 | 🇮🇩 Indonesia | 70 | 2% |

| - | 🌍 Rest of the World | 1,030 | 33% |

| - | World Total | 3,100 | 100% |

North American countries Canada, the U.S., and Mexico round out the top six gold producers, collectively making up 16% of the global total. The state of Nevada alone accounted for 72% of U.S. production, hosting the world’s largest gold mining complex (including six mines) owned by Nevada Gold Mines.

Meanwhile, South Africa produced 110 tonnes of gold in 2022, down by 74% relative to its output of 430 tonnes in 2000. This long-term decline is the result of mine closures, maturing assets, and industrial conflict, according to the World Gold Council.

Interestingly, two smaller gold producers on the list, Uzbekistan and Indonesia, host the second and third-largest gold mining operations in the world, respectively.

The Outlook for Global Gold Production

Gold prices have been hovering around the $1,900-$2,000 per ounce near all-time highs. For mining companies, higher gold prices can mean more profits per ounce if costs remain unaffected.

According to the World Gold Council, mined gold production is expected to increase in 2023 and could surpass the record set in 2018 (3,300 tonnes), led by the expansion of existing projects in North America. The chances of record mine output could be higher if gold prices continue to increase.

Precious Metals

Charted: 30 Years of Central Bank Gold Demand

Globally, central banks bought a record 1,136 tonnes of gold in 2022. How has central bank gold demand changed over the last three decades?

30 Years of Central Bank Gold Demand

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

Did you know that nearly one-fifth of all the gold ever mined is held by central banks?

Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967.

However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold.

The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

- Balancing foreign exchange reserves

Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. - Hedging against fiat currencies

Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. - Diversifying portfolios

Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility.

The Switch from Selling to Buying

In the 1990s and early 2000s, central banks were net sellers of gold.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

| Rank | Country | Amount of Gold Bought (tonnes) | % of All Buying |

|---|---|---|---|

| #1 | 🇷🇺 Russia | 1,888 | 28% |

| #2 | 🇨🇳 China | 1,552 | 23% |

| #3 | 🇹🇷 Türkiye | 541 | 8% |

| #4 | 🇮🇳 India | 395 | 6% |

| #5 | 🇰🇿 Kazakhstan | 345 | 5% |

| #6 | 🇺🇿 Uzbekistan | 311 | 5% |

| #7 | 🇸🇦 Saudi Arabia | 180 | 3% |

| #8 | 🇹🇭 Thailand | 168 | 2% |

| #9 | 🇵🇱 Poland | 128 | 2% |

| #10 | 🇲🇽 Mexico | 115 | 2% |

| Total | 5,623 | 84% |

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion.

| Country | 2022 Gold Purchases (tonnes) | % of Total |

|---|---|---|

| 🇹🇷 Türkiye | 148 | 13% |

| 🇨🇳 China | 62 | 5% |

| 🇪🇬 Egypt | 47 | 4% |

| 🇶🇦 Qatar | 33 | 3% |

| 🇮🇶 Iraq | 34 | 3% |

| 🇮🇳 India | 33 | 3% |

| 🇦🇪 UAE | 25 | 2% |

| 🇰🇬 Kyrgyzstan | 6 | 1% |

| 🇹🇯 Tajikistan | 4 | 0.4% |

| 🇪🇨 Ecuador | 3 | 0.3% |

| 🌍 Unreported | 741 | 65% |

| Total | 1,136 | 100% |

Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States.

Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022.

According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

-

Retail2 weeks ago

Retail2 weeks agoVisualizing the Number of Costco Stores, by Country

-

Markets4 days ago

Markets4 days agoCharted: Market Volatility at its Lowest Point Since 2020

-

Culture2 weeks ago

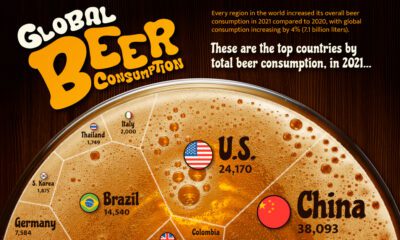

Culture2 weeks agoRanked: Which Countries Drink the Most Beer?

-

Money4 days ago

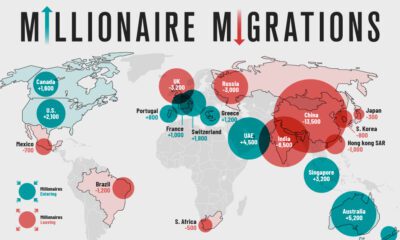

Money4 days agoMapped: The Migration of the World’s Millionaires in 2023

-

AI4 weeks ago

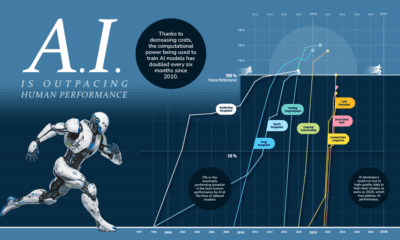

AI4 weeks agoAI vs. Humans: Which Performs Certain Skills Better?

-

Maps2 weeks ago

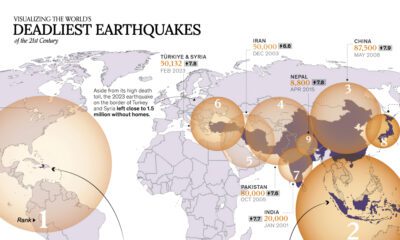

Maps2 weeks agoMapped: The Deadliest Earthquakes of the 21st Century

-

Countries3 days ago

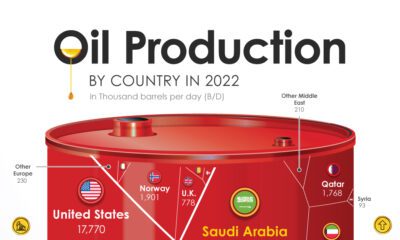

Countries3 days agoCharted: The World’s Biggest Oil Producers

-

Inequality4 weeks ago

Inequality4 weeks agoVisualizing the World’s Growing Millionaire Population (2012-2022)