Money

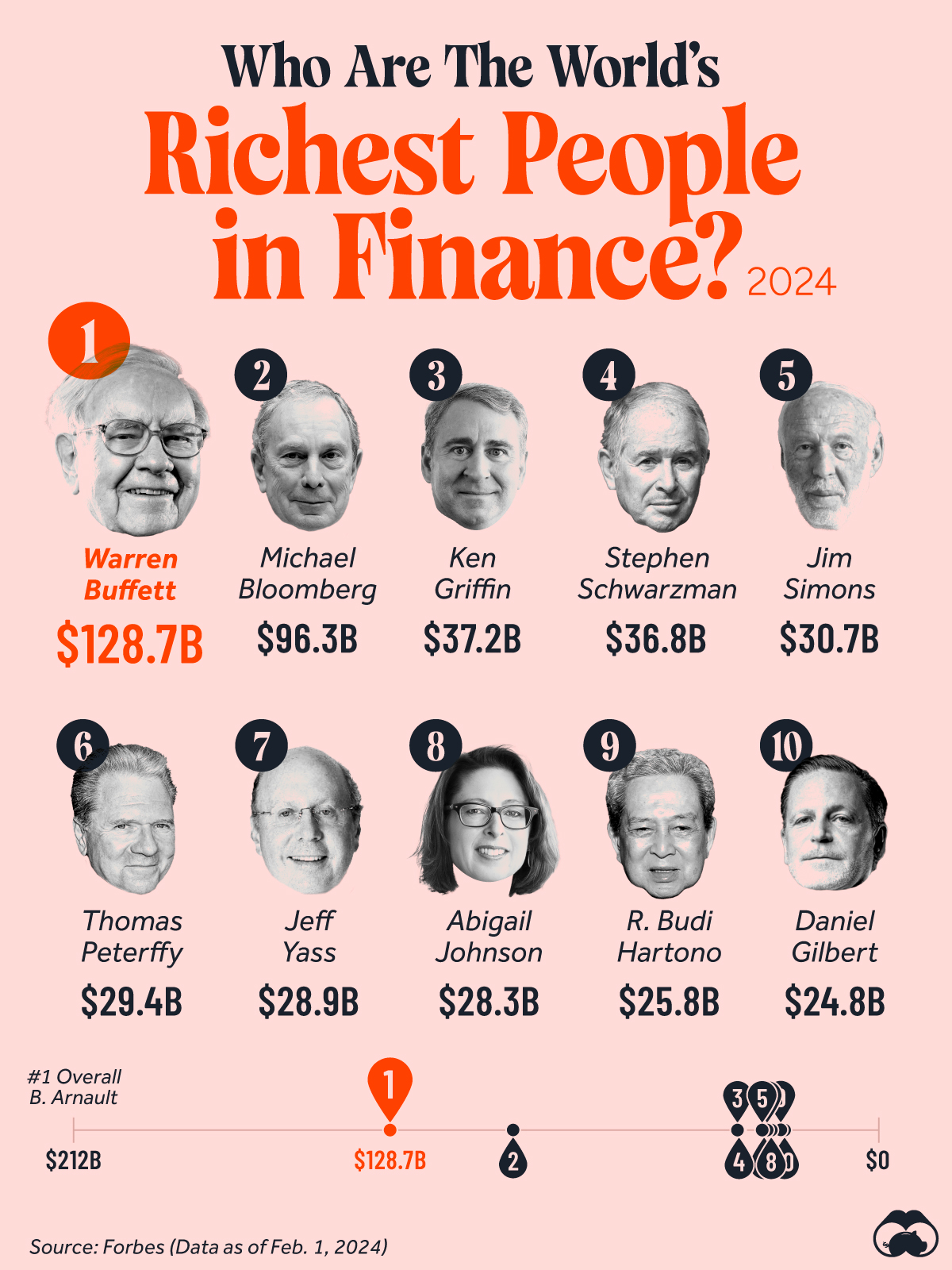

Who are the World’s Richest People in Finance?

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Who are the World’s Richest People in Finance?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The combined net worth of the 10 richest people in finance reached $446.9 billion in 2024.

Here, we rank them based on Forbes data as of Feb. 1, 2024.

The Oracle of Omaha

93-year-old Warren Buffett heads the list. The chairman and CEO of Berkshire Hathaway has a net worth of $128.7 billion.

Buffett’s Berkshire Hathaway portfolio is 62% invested in only three stocks: Apple (42.9%), Bank of America (10.2%) and American Express (9.1%).

Based in Omaha, Nebraska, where he has spent much of his life and where Berkshire Hathaway is headquartered, Buffett is also the 6th richest person in the world.

| Rank | Name | Net Worth |

|---|---|---|

| 1 | Warren Buffett | $128.7B |

| 2 | Michael Bloomberg | $96.3B |

| 3 | Ken Griffin | $37.2B |

| 4 | Stephen Schwarzman | $36.8B |

| 5 | Jim Simons | $30.7B |

| 8 | Thomas Peterffy | $29.4B |

| 6 | Jeff Yass | $28.9B |

| 7 | Abigail Johnson | $28.3B |

| 9 | R. Budi Hartono | $25.8B |

| 10 | Daniel Gilbert | $24.8B |

In second place is Michael Bloomberg, with $96.3 billion. Besides founding the financial data and media company Bloomberg LP in 1981, Bloomberg served as mayor of New York City for 12 years, from 2002 to 2013. A prominent philanthropist, he is committed to donating his stake in Bloomberg LP to Bloomberg Philanthropies when he dies.

In third place, Ken Griffin possesses almost a third of Bloomberg’s net worth. He founded and runs Citadel, a Miami-based hedge fund firm that manages $60 billion in assets. Stephen Schwarzman, Chairman and CEO of Blackstone Group, comes in fourth with $36.8 billion.

The only non-American is Robert Budi Hartono, one of the wealthiest people in Indonesia. His wealth comes from Djarum, one of the world’s largest producers of clove cigarettes, and Bank Central Asia, one of the country’s largest banks.

The lone female on the list is Abigail Johnson. She is the president and CEO of Fidelity Investments. Johnson took over the CEO position from her father in 2014.

Money

The World’s Top 50 Largest Banks by Consolidated Assets

How big are the world’s biggest banks? In this visualization, we show the top 50 banks by assets and headquarters location.

The World’s Top 50 Largest Banks by Consolidated Assets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Banks are often among the biggest companies in the world.

In this graphic, we list the top 50 banks in the world by consolidated assets, based on a 2023 report from S&P Global Market Intelligence. The data represents each bank’s total assets for the most recent period available.

Chinese Banks Keep on Growing

According to S&P, the four largest Chinese banks grew their assets by 4.1% in 2022, reaching a combined total of $19.8 trillion.

In fact, Chinese banks already account for over a third of the assets held by the largest banks on the planet. Four of the 15 biggest companies in China are banks.

| Rank | Bank | Headquarters | Total Assets |

|---|---|---|---|

| 1 | Industrial and Commercial Bank of China | 🇨🇳 China | $5.7T |

| 2 | China Construction Bank Corp | 🇨🇳 China | $5.0T |

| 3 | Agricultural Bank of China | 🇨🇳 China | $4.9T |

| 4 | Bank of China | 🇨🇳 China | $4.2T |

| 5 | JPMorgan Chase & Co. | 🇺🇸 US | $3.7T |

| 6 | Bank of America | 🇺🇸 US | $3.1T |

| 7 | Mitsubishi UFJ Financial Group | 🇯🇵 Japan | $3.0T |

| 8 | HSBC Holdings | 🇬🇧 UK | $2.9T |

| 9 | BNP Paribas | 🇫🇷 France | $2.9T |

| 10 | Crédit Agricole Group | 🇫🇷 France | $2.5T |

| 11 | Citigroup | 🇺🇸 US | $2.4T |

| 12 | Postal Savings Bank of China | 🇨🇳 China | $2.0T |

| 13 | Sumitomo Mitsui Financial Group | 🇯🇵 Japan | $2.0T |

| 14 | Mizuho Financial Group | 🇯🇵 Japan | $1.9T |

| 15 | Bank of Communications | 🇨🇳 China | $1.9T |

| 16 | Wells Fargo & Co. | 🇺🇸 US | $1.9T |

| 17 | Banco Santander | 🇪🇸 Spain | $1.9T |

| 18 | Barclays PLC | 🇬🇧 UK | $1.8T |

| 19 | JAPAN POST BANK | 🇯🇵 Japan | $1.7T |

| 20 | UBS Group | 🇨🇭 Switzerland | $1.7T |

| 21 | Groupe BPCE | 🇫🇷 France | $1.6T |

| 22 | Société Générale | 🇫🇷 France | $1.6T |

| 23 | Royal Bank of Canada | 🇨🇦 Canada | $1.5T |

| 24 | The Toronto-Dominion Bank | 🇨🇦 Canada | $1.5T |

| 25 | China Merchants Bank | 🇨🇳 China | $1.5T |

| 26 | Goldman Sachs Group | 🇺🇸 US | $1.4T |

| 27 | Deutsche Bank | 🇩🇪 Germany | $1.4T |

| 28 | Industrial Bank | 🇨🇳 China | $1.3T |

| 29 | China CITIC Bank International | 🇨🇳 China | $1.2T |

| 30 | Shanghai Pudong Development Bank | 🇨🇳 China | $1.2T |

| 31 | Morgan Stanley | 🇺🇸 US | $1.2T |

| 32 | Crédit Mutuel | 🇫🇷 France | $1.2T |

| 33 | Lloyds Banking Group | 🇬🇧 UK | $1.1T |

| 34 | China Minsheng Banking | 🇨🇳 China | $1.1T |

| 35 | Intesa Sanpaolo | 🇮🇹 Italy | $1.0T |

| 36 | ING Groep | 🇳🇱 Netherlands | $1.0T |

| 37 | The Bank of Nova Scotia | 🇨🇦 Canada | $1.0T |

| 38 | UniCredit | 🇮🇹 Italy | $917B |

| 39 | China Everbright Bank | 🇨🇳 China | $913B |

| 40 | NatWest Group | 🇬🇧 UK | $868B |

| 41 | Bank of Montreal | 🇨🇦 Canada | $859B |

| 42 | Commonwealth Bank of Australia | 🇦🇺 Australia | $837B |

| 43 | Standard Chartered | 🇬🇧 UK | $820B |

| 44 | La Banque Postale | 🇫🇷 France | $797B |

| 45 | Ping An Bank | 🇨🇳 China | $772B |

| 46 | Banco Bilbao Vizcaya Argentaria | 🇪🇸 Spain | $762B |

| 47 | The Norinchukin Bank | 🇯🇵 Japan | $753B |

| 48 | State Bank of India | 🇮🇳 India | $695B |

| 49 | Canadian Imperial Bank of Commerce | 🇨🇦 Canada | $691B |

| 50 | National Australia Bank | 🇦🇺 Australia | $680B |

The Chinese financial market is followed by the American market on our list, with six U.S. banks combining for $13.7 trillion in assets.

The top 10 on the list include four Chinese banks, two American institutions, two French, one Japanese, and one British.

The biggest climber on our rank was Swiss UBS Group AG. The bank surged to 20th place from 34th in 2021. Its $1.6 trillion asset size has been adjusted to incorporate troubled Credit Suisse Group AG, which UBS agreed to take over in an emergency deal orchestrated by the Swiss authorities in March 2023.

Assets held by the 100 largest banks totaled $111.97 trillion in 2022, down 1.5% from $113.67 trillion a year earlier. Some of the reasons include high inflation, interest rate hikes, and the Russia-Ukraine war, which dampened global economic growth and investor sentiment.

-

Technology5 days ago

Technology5 days agoThe World’s Largest Corporate Holders of Bitcoin

-

Stocks2 weeks ago

Stocks2 weeks agoThe Best Performing Japanese Stocks (1-Year Returns)

-

Stocks2 weeks ago

Stocks2 weeks agoThe World’s Biggest Stock Markets, by Country

-

Markets2 weeks ago

Markets2 weeks agoThe Top Performing Investment Themes of 2023

-

Energy2 weeks ago

Energy2 weeks agoHow Much Does the U.S. Depend on Russian Uranium?

-

War1 week ago

War1 week agoVisualized: Top 15 Global Tank Fleets

-

Markets1 week ago

Markets1 week agoVisualizing the Green Investments of Sovereign Wealth Funds

-

Stocks7 days ago

Stocks7 days agoRanked: The 20 Top Chinese Stocks by Market Cap, and Performance YTD