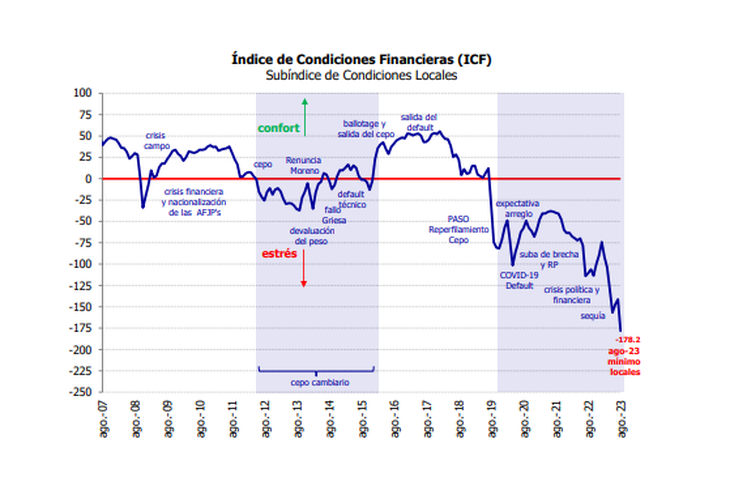

The value of August 2023 is the worst in history, although it must be said that the fall in August was much smaller in points and percentage than in August 2019 when the primary elections also brought surprising results.

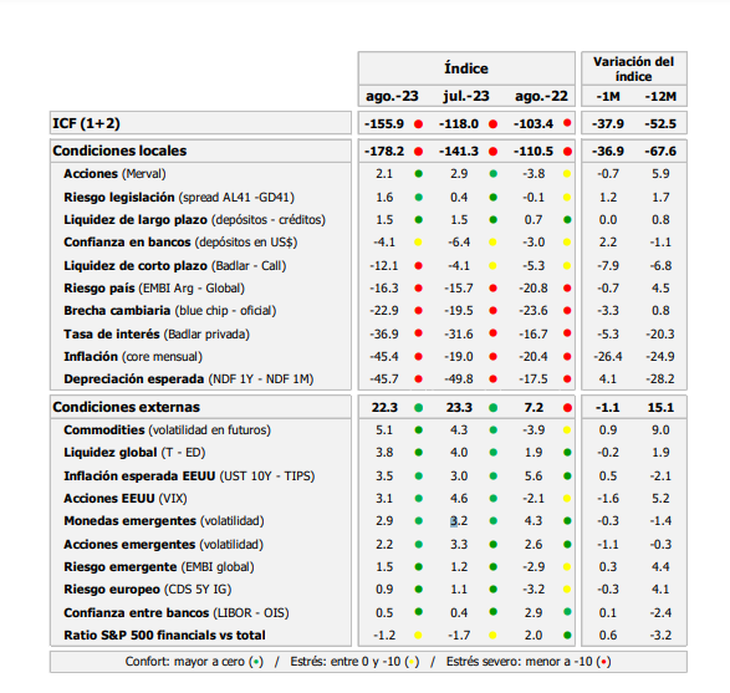

The Financial Conditions Index prepared by the IAEF together with the consulting firm Econviews, ended a streak of two consecutive months of improvement with a strong collapse. The index value fell from -118 to -155.9 points. This is the product of a slight deterioration of the external conditions and a very important deterioration of the local conditions, mainly due to the expected jump in inflation in August, which could almost double compared to July.

The local conditions subindex stood at -178.2 points, a drop of almost 37 points compared to July, which in turn was corrected upwards. He local ICF is negative since August 2019 by way of uninterrupted. The value of agosto 2023 is the worst in history, Although it must be said that the fall in August was much smaller in points and percentage than in August 2019 when the primary elections also brought surprising results.

Financial conditions: why the index deteriorated

It is important to highlight that the worst performance it was because of the inflation and not so much because of the performance of financial assets after the elections.

Six of the ten components fell, one remained the same and three improved. In addition to inflation, the 21-point increase in the rate hit hard and also a reduction in liquidity marked by the difference between the interbank rate and the BADLAR. Improved the expected depreciationwhich is logical given the government’s promise of freeze the exchange rate for two months. He also improved trust in banks, which, as we always say, is a mixed indicator because it reflects a poor credit demand or a crowding out effect if banks lend to the Central Bank instead of to firms and households.

Financial conditions: what was the external outlook in August?

The subscript of external conditions improved fell from 23.3 to 22.3 points. The indicator is now comfortably in the comfort zone. Of the 10 components of the index, 5 improved and another 5 worsened in line with an almost infinitesimal change. American stocks measured by their volatility were the worst component, while the commodity volatility It was the category that added the most to the external ICF.

For the global subindex there is only one component in the stress zone: the ratio between the financial index and the S&P 500, which implies that the banks did not fully recover from the shock at the beginning of the year when they fell 4 banks in the United States. And yet, the variable is at -1.2, that is, it is just below the historical average. Among the variables that are in the best situation, commodities and global liquidity stand out. The raw Materials are also relatively calm and global liquidity is in good shape despite the persistent rate hike of the Federal Reserve.

Financial conditions: what were the three positive data of the month

Three variables that are in positive territory, that is, they are better than their historical average, which is assumed to be zero.

- Local actions

- Premium by legislation

- Long-term liquidity

However, the document warns that «the beginning of September was very inauspicious for stocks, so we should not be surprised that there will be fewer components when the September data comes out.»

Financial conditions: the negative data of the month

- Inflation

- Devaluation expectation

- Nominal interest rate